Econ Intel Brief - May 7, 2025

On today's Fed decision, and the "100% tariff" on movies from "foreign lands"

All,

In today’s EIB, please find:

Key Takeaways from Today’s Federal Reserve Announcement

The target range was held at 4.25% to 4.50%, as widely expected.

Chairman Powell’s press conference starts now (2:30pm ET).

Pres. Trump Announces a “100% Tariff” on movies from “Foreign Lands”

Mailbag

Why are you so optimistic that the U.S. economy won’t enter a recession?

Has the Fed achieved a “soft landing” (low inflation & unemployment)?

Preview of Upcoming Data Releases

Stuff to Read While Waiting for Votes

Email chris@russoecon.com with questions, suggestions, or to request a briefing or testimony. Feel free to forward or subscribe (it’s free). Thanks for your support!

Best,

Chris

Key Takeaways from Today’s Federal Reserve Announcement

At 2pm ET, the Federal Open Market Committee announced that it:

Maintained the target range at 4.25% to 4.50%, as widely expected.

Will continue reducing its holdings of Treasuries, agencies, and agency MBS.

The Desk will redeem up to $5 billion of maturing Treasuries per month.

The Desk will redeem up to $35 billion of maturing agencies/MBS per month.

The Desk will reinvest maturing securities above the caps into Treasuries.

Believes economic activity has expanded at a “solid pace” despite “swings in net exports” affecting the advance estimate of Q1 real GDP growth. (I agree.)

Sees an increased risk of higher inflation and higher unemployment. (I agree.)

Summary of Economic Projections. This meeting did not include an updated SEP.

Market Reaction. At the time of writing,

U.S. stock indices fell on the news, likely due to comments about economic risks.

The on-the-run 10-year Treasury yield was little changed (down a few bps).

Options markets are pricing a 30% chance of a 0.25% cut in June.

Options markets are pricing a total of 3-5 cuts from June through December.

Rules-Based Monetary Policy. A simple policy rule prescribes an overnight interest rate of 4.45%, which is within the Federal Reserve’s target range (4.25% to 4.50%).

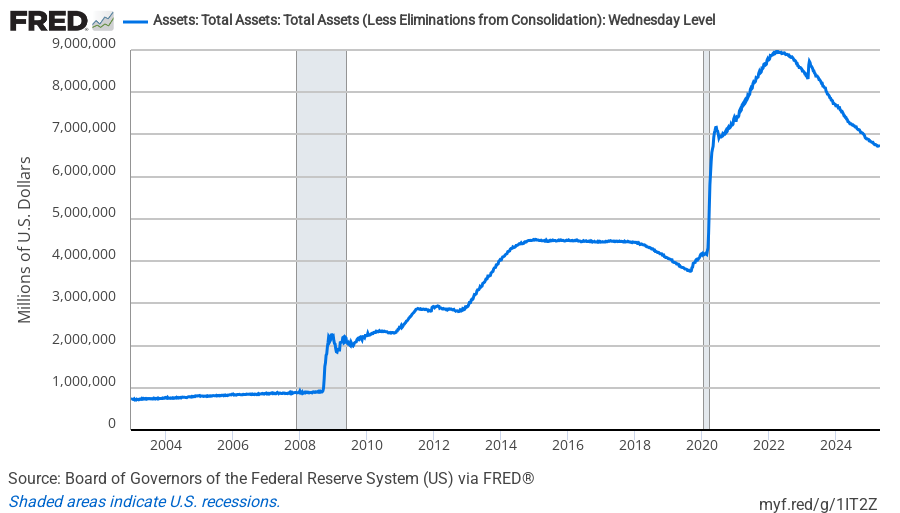

Balance Sheet. The Fed’s balance sheet is about $6.7 trillion, roughly $2.6 trillion higher than pre-pandemic levels. The median respondent to the New York Fed’s March Survey of Market Expectations sees balance sheet runoff ending in July 2025.

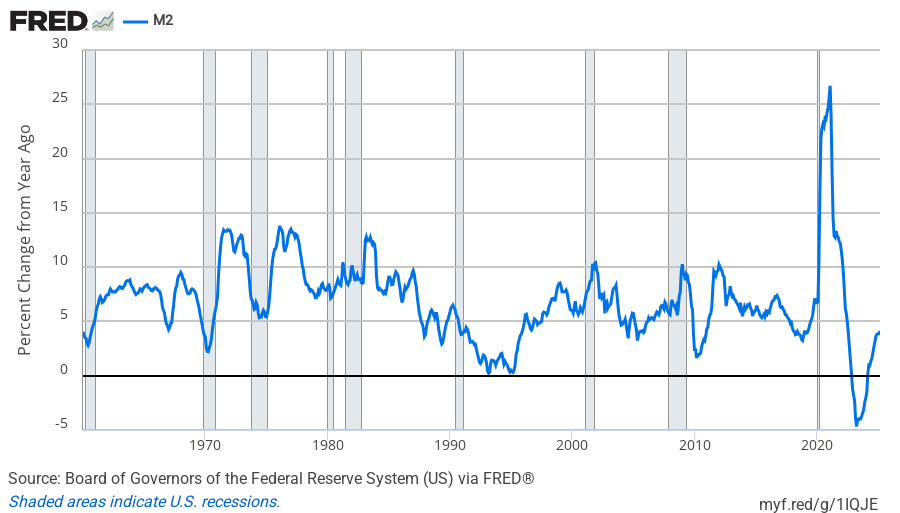

Money Supply Growth. In March,

The M1 money supply grew at 3.2% y/y.1

The M2 money supply grew at 4.1% y/y.2

The Divisia M4 money supply grew at 3.7%% y/y.3

Pres. Trump Announces a “100% Tariff” on movies from “Foreign Lands”

Last week, I commented on a proposal to give the U.S. film and TV industry “federal tax incentives,” which was being pitched to Pres. Trump by a Hollywood actor and producer. Thankfully, Pres. Trump seems to have balked on that idea, which would undercut one of his signature campaign pledges: permanent pro-growth tax reform.

However, on Sunday, Pres. Trump announced a new tariff on foreign-made films, citing a “National Security threat” from film subsidies offered by other countries, as well as “messaging and propaganda” in foreign films.4 (See reporting from WSJ.) This move escalates the trade war with China, which had previously announced it would “moderately reduce” its quota for U.S. film imports because of Pres. Trump’s tariffs.

At this time, it is unclear how the Trump admin plans to levy these tariffs. Films are intellectual property, and licensing IP is defined as a “service” not subject tariffs. E.g., imagine a streaming service that licenses the right to show a foreign film in the U.S. Will the admin try to tax the streaming service 100% of the licensing price it paid?

Pres. Trump citing a “National Security threat” suggests that he is levying the tariffs under the International Economic Emergency Powers Act (or IEEPA). On May 13 at 11am ET, the U.S. Court for International Trade will hear oral arguments about whether IEEPA gives Pres. Trump the power to levy such tariffs. Keep an eye out.

Mailbag

Why are you so optimistic that the U.S. economy won’t enter a recession?

I am not. While I do not think that the U.S. economy is not in a recession today, it might enter a recession later this year. Historically, there is about a 1-in-6 chance per year that the U.S. economy will transition from “expansion” into “recession.” (Imagine rolling a six-sided die every year, and a recession occurs if you role a “1.”)

My gut says that recession risks are currently above this 1-in-6 baseline. The (slightly) negative print for Q1 real GDP growth and downward revisions to Q1 jobs numbers portend weakening economic activity. The U.S. economy also faces substantial headwinds from tariffs as well as (e.g.) state-sponsored attacks on global trade.

However, nothing is baked into the cake. The “advance” estimate for Q1 real GDP growth seems driven by categories subject to considerable measurement error (i.e., inventories and imports). Stripping out volatile categories, “real final sales to private domestic purchasers” grew at a rapid 3.0%.5 Despite the downward jobs revisions, payroll employment still expanded at a healthy pace during Q1. Other key indicators (e.g., industrial production and real personal incomes ex. gov transfers) are healthy.

Lawmakers should not be sanguine about the recession risks. Rather, they should reduce recession risks by pursuing sound economic policy. E.g., pro-growth tax and regulatory reform, deficit reduction, free trade deals, and the protection of commerce.

Has the Fed achieved a “soft landing” (low inflation & unemployment)?

Not yet, but the Fed is close. CPI inflation is 2.4% (down from 9.0% in June 2022).6 Unemployment is 4.2% (up from 3.6% in June 2022). If CPI inflation falls to 2.2% and unemployment does not rise above 4.5%, then I’d call that mission accomplished.7

Since inflation peaked in 2022, my contrarian prediction has been that tighter monetary policy and fiscal policy could reduce inflation without dramatic increases in unemployment. This is contrary to the predictions of Keynesian-style models employed by economists like Larry Summers (including the Phillips Curve).

By contrast to the assumptions of those models, the U.S. generally has competitive labor markets and wage/price flexibility. These conservative policy wins have allowed for tighter fiscal policy and monetary policy to reduce the rate of inflation without severe dislocations to the real economy. This may not have been possible in the past. Republicans should be touting this as a key benefit of conservative economic policies.

At the same time, there are risks that the U.S. economy crashes on the runway. I am concerned that a deficit-financed reconciliation package would increase inflation. Tariffs could also temporarily raise unemployment as some firms fail or downsize.

Preview of Upcoming Data Releases

May 13, 8:30am ET. The BLS will release the consumer price index (CPI) for April.

The Clev. Fed model projects that inflation was modest (0.22% m/m, 2.34% y/y).

Indicates that inflation is continuing to fall back to the Fed’s 2% annual target.

May 29, 8:30am ET. The BEA will release the “second” estimate of Q1 real GDP.

Stuff to Read While Waiting for Votes8

M1 is the narrowest measure of the money supply. Roughly speaking, it includes physical currency, bank demand deposits, bank saving deposits, and money market deposits.

M2 is a somewhat broader measure of the money supply. Roughly speaking, it includes M1, “small denomination” time deposits, and balances in retail money market mutual funds.

The Divisia M4 money supply is a much broader measure of the money supply. It includes (e.g.) M2, money market securities, short-term treasury bills, and credit card balances. Components of Divisia M4 are weighted according to liquidity (or moneyness) of the asset.

“Foreign films” does not just mean the avant-garde foreign-language nonsense shown at film festivals. E.g., “A Minecraft Movie” was shot in New Zealand, and would be subject to this tariff. To date, the movie has grossed nearly $400 million at the domestic box office.

Seasonally adjusted annualized rate

The Federal Reserve’s 2% inflation target is stated in terms of the annual percentage change in the personal consumption expenditures (PCE) price index. PCE inflation typically runs cooler than CPI inflation because (among other reasons) it better captures consumers changing consumption patterns in response to changing relative prices. When inflation is around 2%, PCE inflation tends to be roughly two-tenths of a percent lower than CPI inflation. Hence, I’d like to see CPI inflation get around 2.2% to say inflation is at target.

Links ≠ agreement or endorsement