Econ Intel Brief - May 2, 2025

On today's jobs report, and answering a few common questions from staffers about GDP and federal spending.

All,

In today’s EIB, please find:

Key Takeaways on Today’s Jobs Report

177,000 jobs added; unemployment rate steady at 4.2%; big gains in health care

A Few Common Questions from Staffers

What is the chance that Q1 real GDP growth is revised positive?

How often does real GDP fall in one quarter and rise in the next?

Did Federal spending fall during Q1?

Preview of Upcoming Data Releases

For questions, suggestions, or to arrange an in-person briefing or witness testimony, email chris@russoecon.com or call/text (908) 947-5166.

Feel free to forward. Subscribing is free. You can unsubscribe at any time.

Best,

Chris

Key Takeaways on Today’s Jobs Report

At 8:30am ET, the BLS announced that in April:

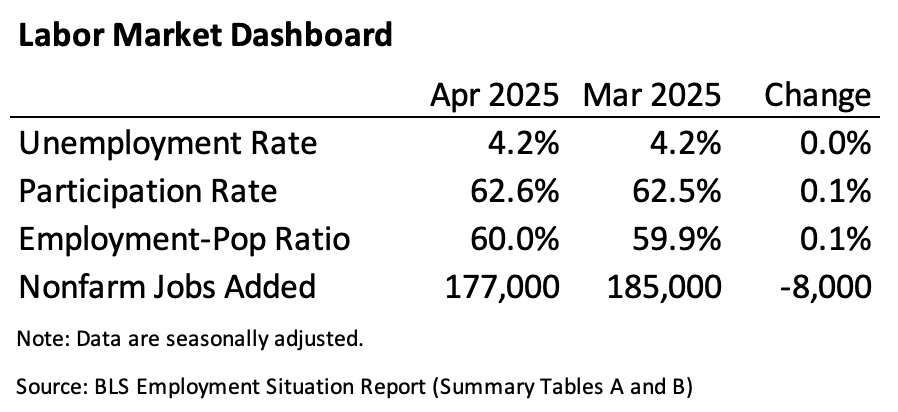

The U.S. economy added 177,000 non-farm jobs, beating expectations of 133,000.

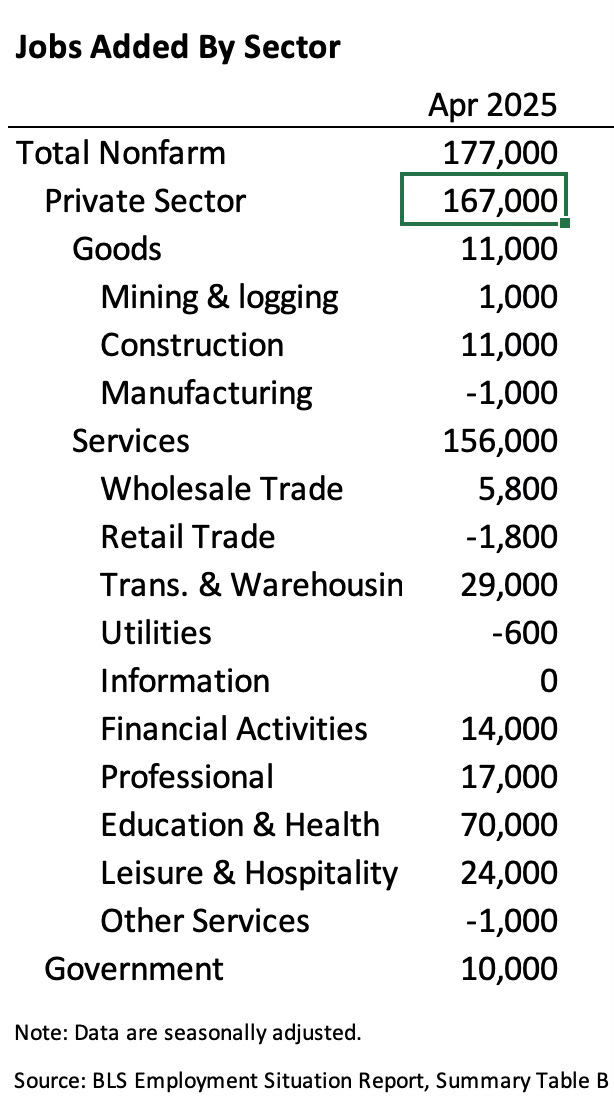

167,000 jobs were added in the private sector, almost all in services.

Notable job gains occurred in the health care sector (51,000 jobs added).

Little/no change in manufacturing and mining. Construction added 11,000.

Federal government employment fell by 9,000 (down by 26,000 since Jan).1

The headline unemployment rate was 4.2%, unchanged from last month.

The labor force participation rate was 62.6%, little changed from last month.

Average hourly earnings rose by 6 cents (0.2%), likely keeping pace with inflation.

However, job gains for Feb and Mar were revised down by a combined 58,000.2

At the time of writing:

U.S. stock markets are not open but equity futures are trading up around 0.9%.

The on-the-run 10-year Treasury yield has ticked up near 4.3%.

Commodities are mixed. Gold is trading up (1.2%). Oil down (-0.3%).

A Few Common Questions from Staffers

What is the chance that Q1 real GDP growth is revised positive?

A bit less than 50%. (I.e., it’s roughly a coin flip.) Remember, the numbers released yesterday are just the “advance” estimate for Q1 real GDP growth. There is a good deal of information missing, which will be incorporated in the next revision. Statistically speaking, real GDP growth is about equally likely to be revised up as a revised down. And any significant upward revision would make GDP growth positive.

How often does real GDP fall in one quarter and rise in the next?

It is uncommon but not unheard of. The four most recent examples are:

Q1 2022

Q1 2014

Q3 2011

Q1 2011

This also happened in Q1 2001 and Q1 2008, but these quarters are during the 2001 and 2008-09 recessions, respectively. (These observations illustrate why the “two consecutive quarters of negative real GDP growth” is just a rule of thumb.)

Did Federal spending fall during Q1?

Total Federal spending slightly rose during Q1. However, Federal spending grew more slowly than prices did. “Real” (aka inflation adjusted) Federal spending fell by 1.4% as a result.3 Given the Federal government’s share of the U.S. economy, this decline in real Federal spending shows up as a -0.25% contribution to real GDP growth in Q1.

This is the first decline in “real” government spending since 2022, when several pandemic-era spending policies expired and inflation rose to a four-decade high.

Preview of Upcoming Data Releases

The Federal Reserve’s next monetary policy meeting is May 6-7.

The current target range for overnight rates is 4.25% to 4.50%.

With employment growth and above target-inflation, options markets are pricing a nearly 100% chance that the Federal Reserve will hold interest rates steady.

Watch for guidance about future rate cuts, or changes to balance sheet runoff.

On May 13, at 8:30am ET. the BLS will release the CPI numbers for April 2025.

The Cleveland Fed model projects that inflation was modest in April (0.22% m/m) and that the 12-month rate of inflation is falling back towards target (2.34% y/y).

Annual CPI inflation tends to be about 0.3% higher than PCE inflation, which is the Fed’s preferred measure. Its 2% target is in terms of annual PCE inflation.

Government employment is up 10,000 because of increases at the state and local levels.

Per the BLS, “Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.”

Expressed at a seasonally adjusted annualized rate.